By ADAM AASEN

Carmel City Councilor

Years ago, you might have seen yard signs popping up around Carmel alerting residents to the fact that the City of Carmel has more than $1 billion in debt.

Years ago, you might have seen yard signs popping up around Carmel alerting residents to the fact that the City of Carmel has more than $1 billion in debt.

Technically, this is true, according to the Indiana Department of Local Government Finance. But like most yard signs, it doesn’t tell the whole story.

In fact, much of that debt will never – and I mean never – be paid by residential taxpayers.

That’s because private developers guaranteed the debt, which was issued to pay for infrastructure improvements like roundabouts and parking garages.

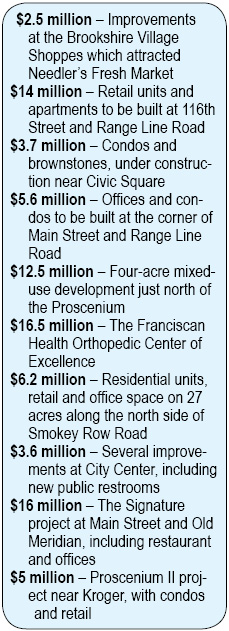

In the last two years, Carmel City Council has approved more than $85 million in developer-backed bonds, encouraging hundreds of millions of dollars in new construction in our city. It’s a tremendous win for our local economy and, again, taxpayers aren’t on the hook. In some cases, the developer just bought the bond.

Yet due to an accounting quirk, it counts as city debt when you look at our totals.

Here’s how it works:

A private developer looks to build on a piece of land.

The Carmel Redevelopment Commission approaches the builder and suggests that instead of building a smaller building with a large sprawling Walmart-style parking lot, they could build a larger building which would generate a lot more jobs and tax revenue for the city. In many cases, these buildings would be of mixed use and feature residences, offices and retail.

The CRC incentivizes this by issuing a bond to fund infrastructure improvements, like parking, and then repays the debt by using the new taxes generated by the increase in assessed value.

The CRC incentivizes this by issuing a bond to fund infrastructure improvements, like parking, and then repays the debt by using the new taxes generated by the increase in assessed value.

This additional tax revenue would not exist if the project wasn’t built to full scale. The larger mixed-use building with a parking garage is worth a lot more in assessed value and so that increase in real estate taxes is captured to put toward paying off the bond.

The city acts only as an “issuer.” If the tax revenue falls short of what’s needed to pay off the bond, the developer is on the hook, not the people of Carmel.

Why is this a good incentive? Because the developer can use their property taxes to pay off the debt associated with the project.

What happens if the developer goes broke? They’re still on the hook for the debt and, in most cases, someone will buy the land and take on the payments.

There is no risk to the public.

This is a huge win. Once the bonds are paid off, tax revenue flows to the city that can be used to pay off other debt or to fund new projects.

The public gets to enjoy new restaurants and public plazas. These parking garages include many spaces open to the public. New jobs bring workers to the area, who pay income taxes and, if they live here, pay property taxes. All of this helps fund schools, parks, road improvements, public safety and more. We all benefit.

Up and down Range Line Road, several new projects are under construction, or will be soon, due to developer-backed bonds. The use of developer-backed bonds is how the City Council was able to help attract the Needler’s Fresh Market in the former O’Malia’s spot. It’s truly a gift for residents of Carmel and future generations as well.

If you have any questions or concerns, don’t hesitate to reach out to me at aaasen@carmel.in.gov.

City Councilor Adam Aasen (R-SE District) represents southeast Carmel, which is east of Keystone Parkway and north of 96th Street. The district borders the north along Main Street from Keystone to Gray Road and along 126th Street from Gray to the eastern city limits.

“What happens if the developer goes broke? They’re still on the hook for the debt and, in most cases, someone will buy the land and take on the payments.“

Good lord, does this guy even remember 2008? Does he not understand what happens when most of the current developers WILL go broke once interest rates rise and current real estate bubble bursts?

John Hooker, the interest rates are locked in when you issue a bond. It’s like when you take advantage of low interest rates and take out a mortgage at the perfect time. We can also refinance bonds when interest rates drop and lock in an even lower rate

Unsurprisingly John, he dodged your pertinent question: If the developer goes out of business, who does the debt fall to? Answer: Taxpayers, aka voters. So Carmel’s cabal of politicians keep singing this same tune to keep all the blinders on the sheep ; they can just skip town if and when the bubble bursts.

Dave, the question he asked was: “don’t you understand that interest rates will crash the economy” and my answer responded to those unfounded fears

To respond to your question: Either way, the City isn’t on the hook to pay the property taxes. If the first lien holder foreclosed, they will pay the property taxes. If the creditor who issued the bond can’t collect they will write off the debt. Basically what you’re asking if what happens if someone doesn’t pay their taxes. We have systems in place and more often than not a private company will buy the property and then pay the taxes. The Carmel residential taxpayers aren’t the ones responsible for paying these bonds

Why not let the free market decide? If a building needs built let the developer decide. The government should not be in the real estate business.

Example. The Free Market did not want to build a Five Star Hotel. Yet, the mayor and the CRC wanted a hotel. Spare no expense. $1.3 billion in debt.

The mayor, the CRC and City counselors say businesses pay taxes. No! They pass the expense to the consumers. It is called Econ 101.

Mr. Aasen, Mr Ryder? You were and are in the restaurant business. When your expenses increased what did you do? They ate in to your bottom line. Did you say oh well? I do not need the extra money. Or did you increase your prices? Give less raises? Pay less? Hire less people.

The bottom line. Consumers pay taxes.

Mr. Aasen. Please tell all of us how much we buy and sell land for.

Tell them how much we paid for The Arby’s and Party Time rental property’s. Then explain why we sold it to the developer for $150,000. Tell them how much we paid for the property where Anthony’s Steak house is. Explain why we sold it to them for a dollar. Tell that we paid $2,8 million for where the Pizza hut is across from City Center. And why we sold it to Old Town Design Group for $100.00

We all know why we buy land and give it to the CRC. They do not have to show the books.