By ISAAC TAYLOR

On Wednesday, President Joe Biden announced his administration’s plan to cancel some federal student loan debt for many holders across the country.

For borrowers who earn less than $125,000 per year, up to $10,000 of debt will be forgiven, and up to $20,000 for those who had received federal Pell grants to help pay for college.

What if I have less than $10K in debt?

If your total outstanding federal student loan balance is less than the relief to which you are entitled, only the balance of your loan(s) will be forgiven. You will not receive a cash payment for the value of the unused portion of your debt relief.

For instance, if you are entitled to $10,000 of debt relief but your loan balance is $8,000, you will not receive a $2,000 payment after the fact. Only the $8,000 loan balance will be forgiven.

How do I get relief?

In a Wednesday afternoon press conference at the White House, the president said over the next few weeks the U.S. Department of Education (DoE) will create an application for qualified borrowers to fill out and submit to get the relief. If the DoE already has your income information, federal officials say you will automatically get the loan forgiveness appropriate to your situation.

For more information, including how to sign up for email notifications when the loan forgiveness application becomes available, go to studentaid.gov/debt-relief-announcement.

Final pause on payments

The president has authorized one final extension of the pause on federal loan repayments through Dec. 31, 2022, with payments set to resume in January 2023.

The Biden administration claims inflation will not increase due to reinstating loan payments at the same time loan relief is issued. The total reported cost for the federal student loan relief package is approximately $300 billion.

Note that the loan forgiveness plan and payment pause only affect federal student loans, not student loans issued by private institutions like banks or loans through colleges and universities.

Reactions

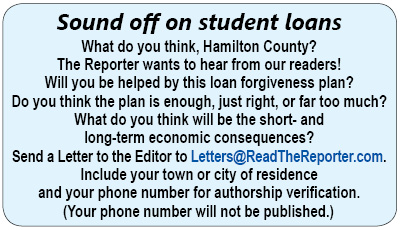

Naturally, this announcement has generated responses from all sides of the political spectrum. Here are just two of those perspectives.

U.S. Senator Mike Braun (R-Ind.) released this response Wednesday afternoon via his press office:

“President Biden isn’t ‘canceling’ debt, he’s shifting it onto everyone, including the majority of Americans who chose not to get a degree,” Braun said. “This will make inflation worse, and we should focus on getting more value out of colleges rather than giving them another reason to hike prices.”

On the other side of the aisle, Indiana Democratic Party spokesman Drew Anderson had this to say:

“Generations of Hoosiers were promised a better future if they followed the rules and went to college, and they were rewarded with unshakeable and burdensome student loan debt that did nothing to create a better future for them,” Anderson said. “President Joe Biden’s decision to forgive some student loan debt is a promise kept and helps families combat global inflation at the same time. While Democrats continue to deliver for Hoosiers, it’s worth noting that every single Republican condemning today’s announcement had no problem supporting a $2 trillion tax cut for big corporations and the rich – a decision that added $8 trillion to the national debt.”