As millions of Americans experience housing insecurity and communities throughout the country face affordable housing shortages and high levels of homelessness, a bipartisan, bicameral group of U.S. Senators and Representatives on Friday introduced legislation to build more than two million new affordable housing units nationwide in the next 10 years and better meet the needs of at-risk groups.

The Affordable Housing Credit Improvement Act of 2021 was introduced by U.S. Senators Todd Young (R-Ind.), Maria Cantwell (D-Wash.), Ron Wyden (D-Ore.), and Rob Portman (R-Ohio) and U.S. Representatives Suzan DelBene (D, Wash.-01), Jackie Walorski (R, Ind.-02), Don Beyer (D, Va.-08), and Brad Wenstrup (R, Ohio-02).

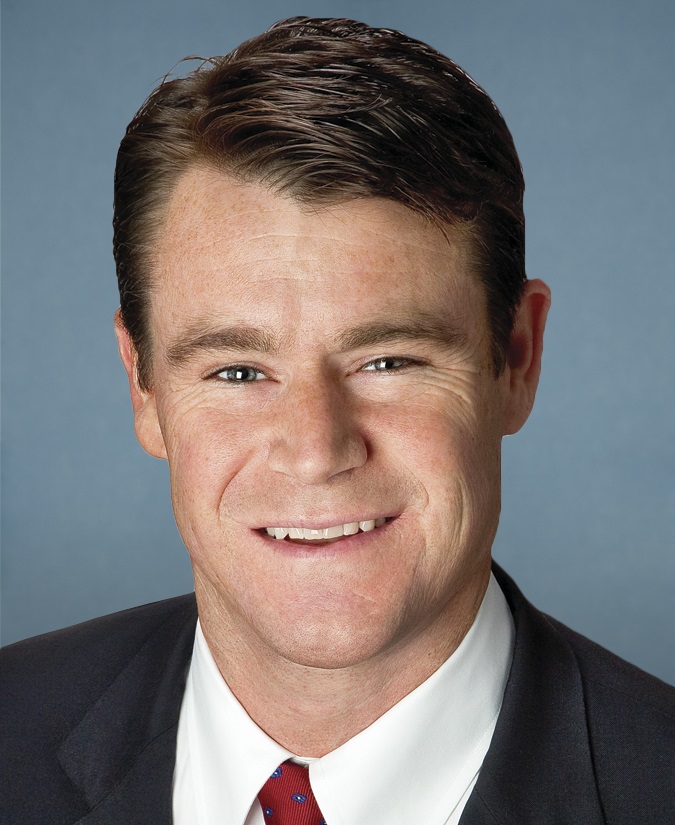

Young

“As I travel around Indiana, one thing is clear: We need affordable housing now more than ever. This pandemic has strained the finances of countless Hoosier families and delayed the construction and rehabilitation of the existing housing supply, worsening an already concerning housing affordability problem across the country. Our bipartisan Affordable Housing Credit Improvement Act will leverage private sector investment to increase the stock of affordable housing for families in both urban and rural communities thereby tackling the housing affordability crisis head on and leading to a better quality of life for Hoosiers,” said Senator Todd Young.

“The State of Washington has an affordable housing crisis, and our experiences are all too familiar for so many communities in every state around the country,” said Senator Cantwell. “Too many people are paying too much money to keep a roof over their heads, and the COVID-19 pandemic has only made the crisis worse. This bill will strengthen and expand our nation’s most successful federal housing program to build more than 66,000 new affordable units around our state and more than two million nationwide over ten years. We know this program works. Now is a critical time to invest in it to fight back against our affordable housing crisis and make sure we’re not leaving families behind.”

“As we get closer to defeating COVID-19 and rebuilding our economy, improving access to affordable housing will play a critical role in our nation’s recovery,” said Congresswoman Walorski. “The Low Income Housing Tax Credit has proven to be an effective tool to drive investment in affordable rental housing and provide stability for vulnerable Americans, including veterans, seniors, and those with special needs. We have an opportunity to build on bipartisan reforms – including the four percent floor rate Congress established at the end of last year – by expanding and streamlining this successful program. I’m grateful to work across the aisle to address the affordable housing crisis, strengthen communities across the country, and ensure workers and families have the opportunity to achieve the American Dream.”

According to Harvard University’s State of the Nation’s Housing 2020 report, more than 30 percent of all households nationwide – 37.1 million American households – spent more than 30 percent of their income on housing. More than 17 million of those households were “severely cost burdened,” spending more than half their income on housing. These statistics come at the same time the United States is facing a nationwide shortage of 6.8 million affordable rental homes.

The Affordable Housing Credit Improvement Act of 2021 would expand and strengthen the nation’s most successful affordable housing program – the Low Income Housing Tax Credit (LIHTC) – to address that shortage by building more than two million new affordable units over the next decade and ensuring the program better serves a variety of at-risk and underserved communities.

The legislation would:

- Increase the amount of credits allocated to each state. The legislation would increase the number of credits available to states by 50 percent for the next two years and make the temporary 12.5 percent increase secured in 2018 – which has already helped build more than 59,000 additional affordable housing units – permanent. This expansion would help build an estimated 299,000 affordable housing units over the next decade.

- Increase the number of affordable housing projects that can be built using private activity bonds. This provision would stabilize financing for workforce housing projects built using private activity bonds by decreasing the amount of private activity bonds needed to secure LIHTC funding. As a result, projects would have to carry less debt, and more projects would be eligible to receive funding. This stabilization would help build as many as 1.5 million new units over the next decade.

- Improve the LIHTC program to better serve at-risk and underserved communities. The legislation would also make a number of improvements to the program to better serve veterans, victims of domestic violence, formerly homeless students, Native American communities, and rural Americans. Collectively these improvements would help build an estimated 222,000 new units over the next 10 years.

The Low Income Housing Tax Credit is the country’s most successful affordable housing program. Since its creation, it has built or rehabilitated more than 3.5 million affordable housing units – nearly 90 percent of all federally-funded affordable housing during that time. Roughly eight million American households have benefitted from the credit, and its activity has supported 5.5 million jobs and generated more than $617 billion in wages and business income.

A wide range of housing advocates and stakeholder groups are supporting the Affordable Housing Credit Improvement Act of 2021:

- “The Affordable Housing Credit Improvement Act is the solution we need now to provide affordable homes for struggling renters and to help rebuild our economy and infrastructure,” said Emily Cadik, Executive Director of the Affordable Housing Tax Credit Coalition. “We applaud Senator Cantwell and the other bipartisan sponsors for their leadership in introducing this legislation that would provide more than 2 million sorely needed affordable homes over the next decade.”

- “NCSHA applauds Senators Cantwell and Young and Representatives DelBene and Walorski for reintroducing the Affordable Housing Credit Improvement Act, which would expand and strengthen America’s best tool for producing and preserving affordable rental housing—the Low-Income Housing Tax Credit. Never has the importance of affordable housing been more clear—and its scarcity felt more severely—than now, a year into a global pandemic, when so many have faced housing instability. It is imperative that Congress pass this bill this year,” said Stockton Williams, Executive Director of the National Council of State Housing Agencies.

- “The National Association of Home Builders commends Sen. Maria Cantwell (D-Wash.) for introducing the Affordable Housing Improvement Act, bipartisan legislation that would improve the Low-Income Housing Tax Credit and spur the production of hundreds of thousands of additional multifamily units over the next decade,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB). “The nation is in the midst of a housing affordability crisis and the only effective long-term solution is to increase supply. With nearly 11 million renter households severely cost-burdened, the Affordable Housing Credit Improvement Act would greatly enhance our ability to meet the growing demand for more affordable rental units.”

- “Throughout our 125 year history, Volunteers of America and its affiliated organizations across the country have seen first-hand that decent, safe housing for veterans is critical to the successful transition to civilian life. Enhancing the Low Income Housing Tax Credit, which provides resources necessary to expand veterans housing, will ensure that our Nation honors the sacrifices of all soldiers and their families by creating communities where they can thrive,” said Sharon Wilson Geno, Executive Vice President and Chief Operation Officer, Volunteers of America National Services.

- “Enterprise appreciates the leadership of Senators Cantwell, Young, Wyden and Portman, as well as Representatives DelBene, Walorski, Beyer and Wenstrup, on the Affordable Housing Credit Improvement Act of 2021,” said Priscilla Almodovar, chief executive officer of Enterprise Community Partners. “This bill will address the shortage of affordable housing that has impacted so many families across the country, both now and before the pandemic.”

- “The Local Initiatives Support Corporation (LISC) and the National Equity Fund (NEF) enthusiastically support the Affordable Housing Credit Improvement Act. The Housing Credit has proven to be the most effective tool for developing, rehabilitating and preserving affordable housing units for low-income families. The AHCIA will lead to a significant increase in the production of housing units at a time when the already tremendous need for affordable housing has been exacerbated in the wake of COVID 19. The AHCIA also includes critical provisions that will make it easier to finance projects in rural communities and those serving very low income families. We appreciate Senator Cantwell’s leadership on this critical legislation,” said Matt Reilein, President and CEO, National Equity Fund, and Matt Josephs, Senior Vice President of Policy, Local Initiatives Support Corporation (LISC).

- “The Affordable Housing Credit Improvement Act is a life changing piece of legislation that will alter the affordable housing landscape throughout the country. The Housing Advisory Group, a national advocacy organization of affordable housing developers and practitioners, strongly supports the AHCIA’s introduction and will enthusiastically work to see it enacted into law. We salute the efforts of Senators Cantwell and Young and Representatives DelBene and Walorski in championing this landmark legislation which will lead to the production and rehabilitation of much needed affordable housing for families, seniors, veterans and many more. As the country emerges from the Covid-19 pandemic, it is imperative that we address the needs of all citizens suffering the effects of the pandemic and accompanying economic downturn. The AHCIA will provide vital resources to meet the structural and housing infrastructure needs of the country,” said David Gasson, Executive Director of the Housing Advisory Group.