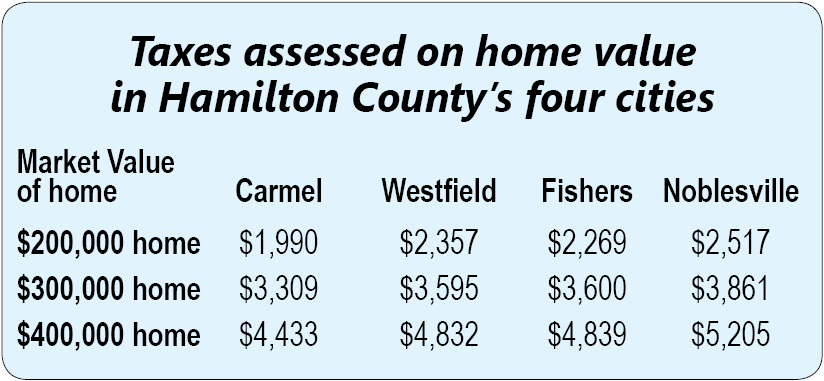

New data from the State of Indiana shows that Carmel continues to be one of best cities in Indiana to live when it comes to paying property taxes. Carmel’s District Tax Rate, which combines the City rate with other taxing units – including the school district, library, township, county and solid waste – adds up to $2.0354 per $100 assessed valuation – a rate that is the fifth lowest in the State of Indiana out of 118 cities.

“Previously, we received information that Carmel had the 11th lowest city-only tax rate in Indiana and that was excellent news for our residential property owners,” said Mayor Jim Brainard. “Now we have even better news to celebrate, thanks to our strategy of focusing on a high quality of life in order to attract corporate and commercial investment dollars that help keep our property taxes low.”