This week, U.S. Senator Todd Young (R-Ind.), along with his Senate Finance Committee colleagues, Senators Maggie Hassan (D-N.H.), Catherine Cortez Masto (D-Nev.), Rob Portman (R-Ohio), and Ben Sasse (R-Neb.), reintroduced the bipartisan American Innovation and Jobs Act to incentivize research and development (R&D) investments by innovative businesses and startups.

Many job creators and industry trade associations have voiced support for the American Innovation and Jobs Act, including the National Association of Manufacturers, the R&D Coalition, Cook Group Incorporated, Intel Corporation, the Motor & Equipment Manufacturers Association, the National Venture Capital Association, Bosch in North America, and the Semiconductor Industry Association.

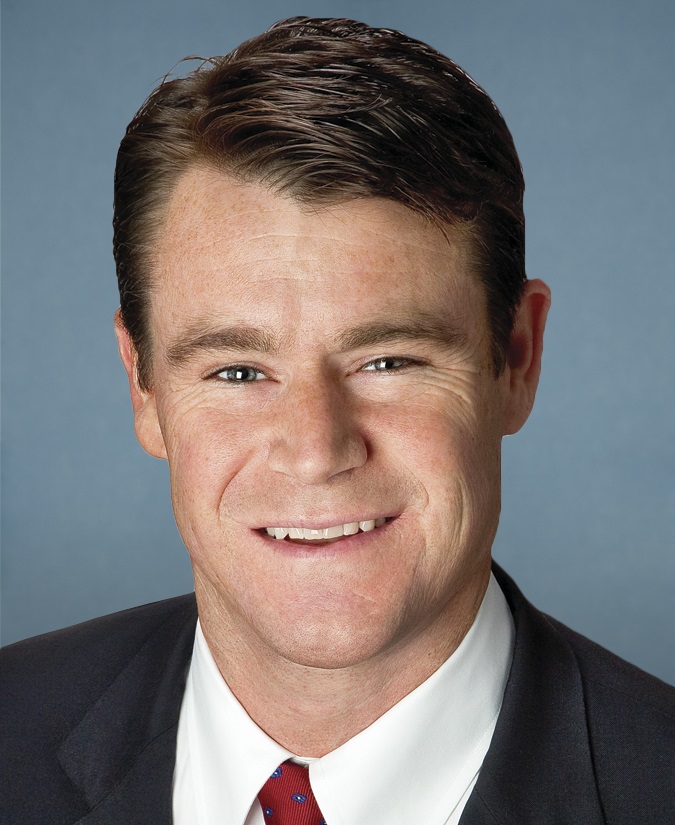

Young

“We are looking forward to building a post-COVID economy and strengthening – even super-charging – our manufacturing sector,” Sen. Young said. “It’s critical that as we think about this we identify as many ways as possible to increase investment in Research and Development (R&D) in this country. To that end, yesterday I reintroduced a piece of legislation – the American Innovation and Jobs Act – along with Senator Hassan. This would expand the R&D Tax Credit for innovative startups and ensure companies can continue to expense R&D costs in the year they are incurred.”

Sen. Young also noted the need to bolster American competitiveness against China, and how supporting domestic research and development through his bill could help.

“In the 21st Century, the U.S.’s share of global R&D investments has fallen drastically from 39 percent to 29 percent,” Sen. Young said. “Meanwhile, we continue to face stiff competition from countries like China. China has aggressively focused on growing its R&D sector and by some estimates will surpass American R&D investment just by the end of this decade. If we fail to take our competitors seriously, I have grave concerns about the ability of the U.S. to maintain our role as a global leader in this regard.”

Background

Companies and startups investing in R&D can either claim a tax credit or deduct their investments, which helps them to invest in developing new, innovative products that lead to additional jobs and a stronger economy. The bipartisan American Innovation and Jobs Act doubles the refundable R&D tax credit and extends it to more startups and small businesses. It also ensures that companies who do not elect to take the credit may continue to deduct the full amount of their R&D expenses in the year they are incurred – an important tax incentive that expires at the end of this year.

The American Innovation and Jobs Act supports innovative businesses and helps create jobs by:

- Restoring incentives for long-term R&D investment by ensuring that companies can continue to fully deduct R&D expenses each year.

- Immediately doubling and then further raising the cap over time for the refundable R&D tax credit for small businesses and startups.

- Expanding eligibility for the refundable R&D tax credit so that more startups and new businesses can use it.

Click here to read the full text of the bill.