State-mandated changes coming to your property tax bill

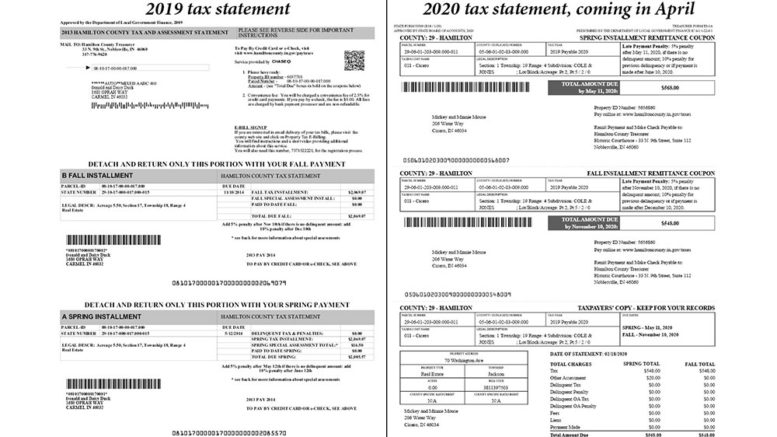

The Hamilton County Treasurer’s Office wants you to know that this year your property tax bill will look a bit different, but it will contain all the same information from previous years. The reason for this is a state-mandated change to standardize tax billing across the state.

According to Indiana Department of Local Government Finance (DLGF) Communications Director Jenny Banks, the “coupon” portion of the tax bill has been different in each of Indiana’s 92 counties. The coupon is the portion of the tax bill you detach and return with your payment.

“This change is for the taxpayers if they have property in different counties,” Banks told The Reporter. “For example, if you own two properties where one is in Marion County and one is in Hamilton County, now you will have the same consistent tax bill across all counties.”

According to information from the DLGF, the revisions are all technical in nature with the exception of the remittance coupon. There are no new fields or data points.

Templeton

The new guidelines include specific details on the paper size, font type and size, and the limited options for color that may not be used. According to Hamilton County Treasurer Jennifer Templeton, Hamilton County forms will be printed entirely in black ink.

“After receiving the mandated information from the DLGF in November 2019, we have been working diligently with our software vendor and printers to build our system documents to make sure that the new statements meet the requirements,” Templeton said. “I feel that the new format will be easy to read, and my goal is to make sure that the taxpayers are informed of these changes to make the transition for all easier.”

A video explanation of the changes is available on the Treasurer’s Office website and at this link.