Submitted

Despite many economic experts’ worst fears early in the COVID-19 pandemic, state and local government budgets have proven resilient over the last two years.

With much of the economy shut down or hobbled as a result of the pandemic, forecasters initially worried that states and localities would collect substantially lower amounts of sales and income tax and face major budget shortfalls as a result. But behind falling unemployment, rising wages and strong consumer spending, income and sales taxes have produced stronger-than-expected revenues since the initial shock of the pandemic.

One factor that has helped protect state and especially local revenues over this period is property taxes, which are taxes levied on real property like land and buildings or certain forms of personal property. Property taxes tend to be more stable over time because property values are less susceptible to economic volatility than income and sales tax.

Depending on when taxes are assessed, it could take years for any significant changes in property values to become apparent in a government’s tax collections. This certainly helped keep property tax revenues steady during the pandemic – and for some communities, collections could potentially grow in coming years due to the skyrocketing values of residential real estate.

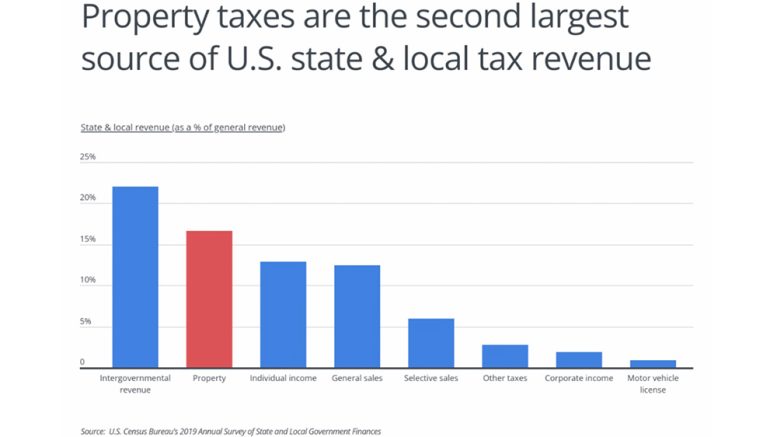

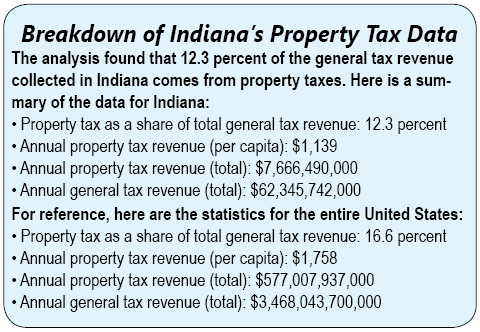

Property taxes’ stability could help continue to protect state and local budgets if the U.S. is headed toward a recession in the near future. Across the country, property tax collections represent 16.6 percent of state and local general tax revenues, which makes it the largest form of “own-source” revenue generated by states and localities, ahead of individual income (12.9 percent) and general sales taxes (12.5 percent).

Among all revenue sources, property tax trails only intergovernmental funds (22 percent), which comprises funds transferred from one government to another (most frequently federal to state or local) through grants, loans, and other agreements.

However, the overall mix of state and local revenue sources looks different across the U.S. Each state and local government offers a unique collection of revenue sources that weights income, sales, property, and other taxes differently.

However, the overall mix of state and local revenue sources looks different across the U.S. Each state and local government offers a unique collection of revenue sources that weights income, sales, property, and other taxes differently.

For example, nine states have no state income tax, while five have no state sales tax. Others have caps on property tax rates or restrictions around how property valuations are conducted that limit the amount of revenue from property taxes. This means that individuals’ specific tax burdens will look different depending on what state and local tax laws are in place where they live.

Property tax collections across the states show these differences in action.

At the low end, only 6.9 percent of general tax revenue collected in Alabama comes from property tax, while at the high end, property tax is 36.5 percent of general tax revenue in New Hampshire. New Hampshire stands out in part because the state has neither an income nor a sales tax, so many services are funded at the local level through property taxes. Many of the other locations highly dependent on property taxes are nearby Northeastern states, including New Jersey, Maine, and Connecticut.

The data used in this analysis is from the U.S. Census Bureau’s 2019 Annual Survey of State and Local Government Finances. To determine the states that collect the most property tax revenue, researchers at Porch calculated property tax revenue as a share of total general tax revenue. In the event of a tie, the state with the greater annual property tax revenue per capita was ranked higher.

For more information, a detailed methodology, and complete results, you can find the original report at this link.