Janelle Campbell, mortgage loan office for Community First Bank of Indiana, and Bobbi K. Samples with Anthony Team Realty, LLC and F.C. Tucker Co. are teaming up to offer a home buying seminar for anyone in Hamilton County who may need to learn more about the process. Both ladies have lived in Hamilton County since 2002 and thus know the area and the needs of homeowners.

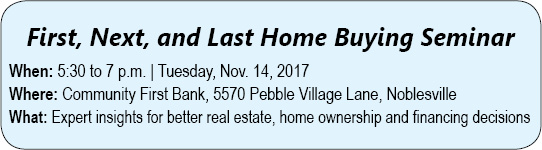

The seminar will take place from 5:30 to 7 p.m. on Tuesday, Nov. 14 at First Community Bank of Indiana, 5770 Pebble Village Lane, Suite 400, Noblesville.

First Community has strong roots in Howard County and moved into Hamilton County in 2015.

Campbell

“We are well-established in the Kokomo, Howard County market, so the bank was looking to expand their territory and wanted to come into the northern Hamilton County area,” Campbell said. “That happened to be during the time when other local banks were unfortunately being gobbled up by bigger banks, so we are trying to bring that community banks atmosphere and feeling back to the Hamilton County area. We are excited to be able to offer quick, local decisions and interpersonal relationships back to the area.”

The Pebble Village Lane office started out as solely a loan production office. In January they transitioned the location into full-service banking.

“We are in the process of building a location in Westfield,” Campbell said. “We closed on out property last week. That will be our second location in Hamilton County and will become our main hub for Hamilton County as we add other branches.”

The Westfield location will be a full-service free-standing branch on the corner of State Road 32 and Oak Ridge Road.

Samples notes that community banking is something the area needs.

Samples

“It is something that has been missing for a few years since a lot of the smaller banks and community banks got bought by large banks,” Samples said.

One of the things that making Community Frist unique on the mortgage side is that their underwriters are in-house.

“My underwriters are at our Kokomo office,” Campbell explained. “We do all of our underwriting and make all of our decisions here. We don’t have to send files off to Texas or Arizona or California. We have more flexibility because of that. A decision might take a couple hours, but usually within 24 hours at the longest I can get an answer back to the buyer of ‘yes, we can do this’ or that we need to fix this or tweak that and have a plan in place.”

The seminar is open to the public, but space is limited.

“There will be several speakers involved,” Samples said. There will also be free wine-tasting as part of the event.”

You don’t need to bring anything with you if you attend and there is no commitment. If you do wish to ask confidential questions, you will have the opportunity to do so outside the group setting. You can also meet with the speakers after the event or schedule a private meeting.

“It is mostly to get people asking the questions,” Samples said. “To help them know what they need to ask and what they may need to know. No one is going to be disclosing their personal information if they don’t want to. It’s a questions and answer just to get people started. You don’t need to feel like you need to come with your taxes. It’s informational to get your feet wet. Anyone that wants follow-up that we can help with, we will. If nothing else, come for the wine tasting!”

Campbell pointed out the seminar is going to be in November because they want to help people be ready for the market in 2018.

“One of the reason we chose this time before the holidays is because if someone is looking to potentially buy a house at the beginning of next year, then let’s talk about the credit part of it before we head in to the holidays,” Campbell said.

Samples said the follow questions will be addressed at the seminar:

Samples said the follow questions will be addressed at the seminar:

- If you want to list in the first part of 2018, what do you need to do to your home to get it ready?

- What is the current market value?

- What is it going to look like in the spring?

“There is never a bad time to list, but sometimes are better than others,” Samples explained. “The most number of people looking to buy are in the spring. They know it takes a process so they allow 2-4 months to do that so they can get out in the summer and get into a new school system before fall gets settled in. Most buyers are March through August.”

If you want to learn more about buying a house in Hamilton County in 2017, RSVP is necessary due to limited space. For questions, and to register, contact Janelle Campbell at (317) 399-7492 or jcampbell@cfbindiana.com, Bobbi K. Samples at (317) 840-9585 or bobbik@talktotucker.com or by clicking here.