Submitted

Mike Corbett has five key principles driving his campaign for mayor of Noblesville. Each week he takes a deep dive into each of the five principles. Over the past two weeks he explained what improved transparency looks like and how historic preservation can be an economic development strategy.

The third principle is a greater respect for the Noblesville taxpayer.

Corbett

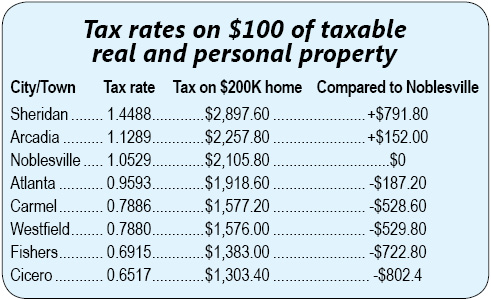

“I pay close attention when the tax table comes out each year,” says Corbett. The table lists tax rates for Hamilton County towns and cities and it’s a good way to see how the communities compare to each other. Noblesville’s city tax rate is the third-highest in the county, behind Sheridan and Arcadia.

“Small towns struggle because they have a small tax base,” says Corbett, “We have a much larger tax base in Noblesville but our rate is comparable to the smaller towns. In fact, Atlanta’s rate is lower than ours. Worse yet, we compare poorly to our peer cities, despite the fact that they all have had huge public projects recently. Our city rate is 33 percent higher than Westfield’s and Carmel’s, and 52 percent higher than Fishers’, which means we pay $530 more in taxes each year than Carmel and $723 more than Fishers on a home assessed at $200,000.”

And, Corbett added, that doesn’t even include the trash fee, a tax disguised as a fee, and the fact that Noblesville has had more school referendums than any other community in the state, which raise taxes even higher. Renters are hit harder still because rental properties have a higher tax cap than owner occupied homes. According to several landlords, if they charge $1,500 a month in rent, $300 to $500 of that goes directly to taxes.

So, what’s going on? Corbett cites a lackluster economic development effort over the past decade or more. “We need to grow our assessed valuation (i.e. tax base) to help relieve the residential taxpayer and you do that by increasing your commercial and industrial base,” he says. “Our efforts pale in comparison to other Hamilton County cities and it shows in our tax rate. We’ve been losing ground to them for years. You can’t hide from the facts.”

Corbett also blames a willingness to give tax relief to corporations that don’t need or deserve it. “Tax abatements are meant to help spur economic development by helping corporations who are willing to build in economically challenging areas,” he said. “But we give them away like candy to businesses who build on our most desirable land. It amounts to millions of dollars each year and helps keep our tax rate high. It’s just very poor management.”

Corbett also blames a willingness to give tax relief to corporations that don’t need or deserve it. “Tax abatements are meant to help spur economic development by helping corporations who are willing to build in economically challenging areas,” he said. “But we give them away like candy to businesses who build on our most desirable land. It amounts to millions of dollars each year and helps keep our tax rate high. It’s just very poor management.”

Corbett also promises to take a close look at TIF (tax increment financing) Districts to make sure they are performing as promised and are not being abused. “I will make sure they’re being used properly to the benefit of you, the taxpayer.”

“Noblesville taxpayers have been very patient,” said Corbett, “but we cannot maintain this stagnation and lackluster performance for another four years. The time for change is now.”

For more information, please visit mikecorbettformayor.com. Connect with Mike on Twitter, Facebook and Instagram.