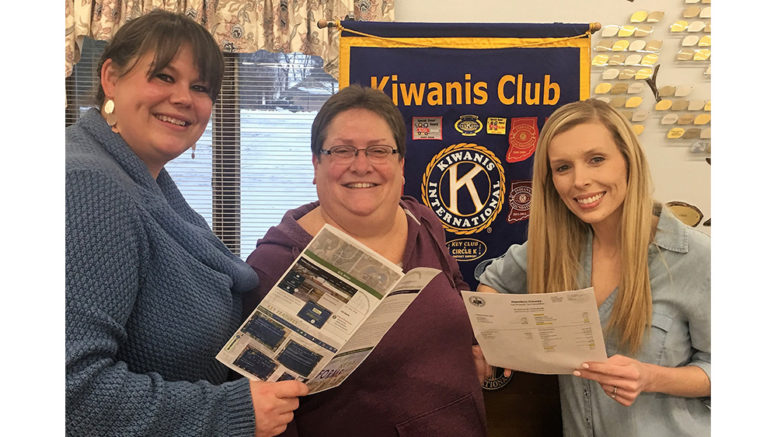

Sadie Eldridge and Sarah Hanje from the Hamilton County Auditor’s office spoke at the breakfast meeting of the Cicero Kiwanis Club last Saturday. They enlightened members with an interesting and informative program on the vast role, function and services of this office.

In a nutshell, the Office of the Hamilton County Auditor works to provide financial leadership, ensure financial integrity, protect county assets and maintain accurate financial and accounting records. The duo shared the importance of understanding and taking advantage of eligible deductions and credits by Dec. 31 for the preceding tax year. Some deductions and credits can be made online, while others need to be made in person.

An area that has been an increasing focus of the office revolves around reducing the incidence homestead credit fraud. Increased education, technological advances and better coordination between departments around the county, state and country has greatly reduced the incidence of homestead fraud, which has the potential for significant penalties and causes higher tax bills for everyone.

Individuals and married couples are limited to one homestead standard deduction per homestead laws (per IC 6-1.1-12-37 and IC 6-1.1-20.9). The State of Indiana has recently passed legislation (IC 6-1.1-36-17) allowing the county auditor to back tax and add a penalty for those property owners deemed ineligible.

“In terms of who is committing the fraud, it’s about a 50/50 split of those who intentionally seek credits for multiple properties and those who didn’t know they were doing anything wrong,” said Eldridge. “The bottom line is the penalty is the same.”

Cicero Kiwanis Club President Robin Mills, who is into her third term as the Hamilton County Auditor, wrapped up the program by providing members with an easy way to remember who is responsible for what segment of office operations. The Auditor is responsible for deeds and mapping. The Assessor assesses. The Auditor bills. The Treasurer collects and the Auditor settles.

For more information related to deeds, mapping, property tax calculations, deductions, credits, tax bills, forms and/or questions, please visit click here or call 317-776-8401.