By SETH WILSON

Adler Attorneys

Starting Jan. 1, 2024, almost every business entity that was created through a state filing service in the United States was required to report the Beneficial Ownership Information (BOI) to the U.S. Department of the Treasury’s Financial Crime Enforcement Network (FinCEN). Failure to file may result in up to two years in prison and a fine of $10,000. Exceptions are limited.

Beneficial owners include individuals who directly or indirectly exercise substantial control over the reporting company, or who owns or controls 25 percent or more of the company. Substantial control is broadly defined to include senior officers, those who have the ability to appoint or remove senior officers, or a majority of the board of directors, those who have substantial influence over important decisions, and those who have any other form of substantial control over the company.

The requirements for the report will be as follows:

- The entity’s legal name and trade names including D/B/A’s;

- The address of the business;

- The jurisdiction in which it was formed or first registered; and

- The business’ Taxpayer Identification Number (TIN).

Additionally, each beneficial owner within each company will need to provide in the report:

- The beneficial owner’s legal name;

- The beneficial owner’s date of birth;

- The beneficial owner’s address; and

- The beneficial owner’s identifying number – such as a driver’s license, passport, or other approved document – as well as an image of the document that the number is from.

All businesses that have been created or registered before Jan. 1, 2024, were supposed to have filed by Jan. 1, 2025. Companies created or registered after Dec, 31, 2023, must file within 30 calendar days of formation. Reports were accepted for filing beginning Jan. 1, 2024.

Additionally, any updates or changes within the company will require the company to file a report of changes within 30 days of the change occurring. If there are any inaccuracies within a filed report, a company will have 30 days to report such an inaccuracy. There are no safe harbor provisions for filing an incorrect report.

As you can imagine, this law has caused quite a stir among business owners, prompting several different lawsuits in various jurisdictions. The main issue is with the constitutionality of requiring that this information be reported to the federal government. Just prior to the deadline to report, a Federal Court in Texas issued a nationwide injunction “pausing” the requirement to report.

In recent weeks, we’ve seen a lot of activity surrounding this law and the reporting requirement, causing business owners who haven’t yet report some understandable concern. It’s been an on-again / off-again situation.

Most recently, one case made it all the way to the United States Supreme Court. On Jan. 23, 2025, the U.S. Supreme Court “unpaused” the reporting requirements in one of the cases. This would lead you to believe that the reporting requirements are in place again.

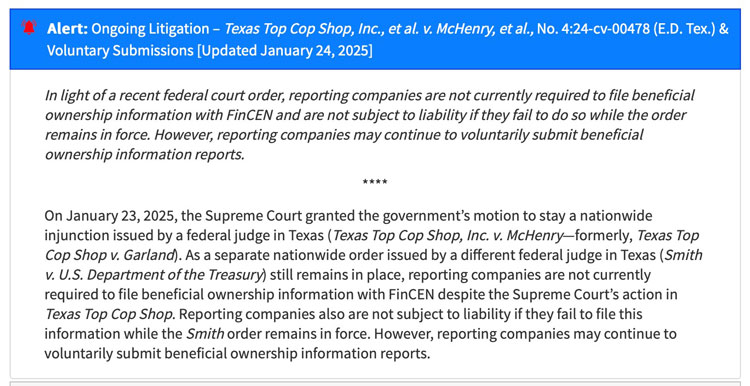

However, a visit to the FinCEN website reveals that there is another case in which a judge has issued a nationwide injunction (“pause”) against the reporting requirements. Because of that case, the website* advises:

On January 23, 2025, the Supreme Court granted the government’s motion to stay a nationwide injunction issued by a federal judge in Texas (Texas Top Cop Shop, Inc. v. McHenry—formerly, Texas Top Cop Shop v. Garland). As a separate nationwide order issued by a different federal judge in Texas (Smith v. U.S. Department of the Treasury) still remains in place, reporting companies are not currently required to file beneficial ownership information with FinCEN despite the Supreme Court’s action in Texas Top Cop Shop. Reporting companies also are not subject to liability if they fail to file this information while the Smith order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.

Graphic provided / fincen.gov/boi

To file or not to file, that is the question. With the alphabet soup of acronyms and on/off nature of this potential obligation, it’s definitely an unsettling time for business owners. One thing is clear: this is a difficult question with nationwide implications. It appears the Courts are interested in resolving the legal questions involved in this case for the benefit of all citizens, but the U.S. Supreme Court seems interested in having the lower courts finish the appeal before weighing in on all the legal issues involved.

*Available at fincen.gov/boi